How does CLT homeownership compare to renting?

CLT home ownership is an alternative to renting that provides opportunity for people to build equity instead of paying a landlord.

CLT home ownership provides people with increased stability and security. CLT home owners have control of their homes, benefit from stable monthly housing costs, and the opportunity to accumulate equity. CLT home owners can also take advantage of income tax deductions for their property taxes and the interest paid on their mortgage.

How does CLT homeownership compare to market rate homeownership?

Land trust home ownership is like market-rate ownership except that CLT home owners agree to pass the home’s original affordability on to the next buyer.

Similarities:

- The home owner has a mortgage with a bank;

- The home owner accumulates earned equity by paying down their mortgage;

- The home owner pays property taxes;

- The home owner can make alterations and improvements; and,

- The home owner may receive federal tax deductions for mortgage interest and property taxes.

Differences:

- The purchase price is lower because the CLT brings subsidy to the property;

- The CLT and home owner enter into a long-term agreement (the Ground Lease) to preserve the home’s affordability; and,

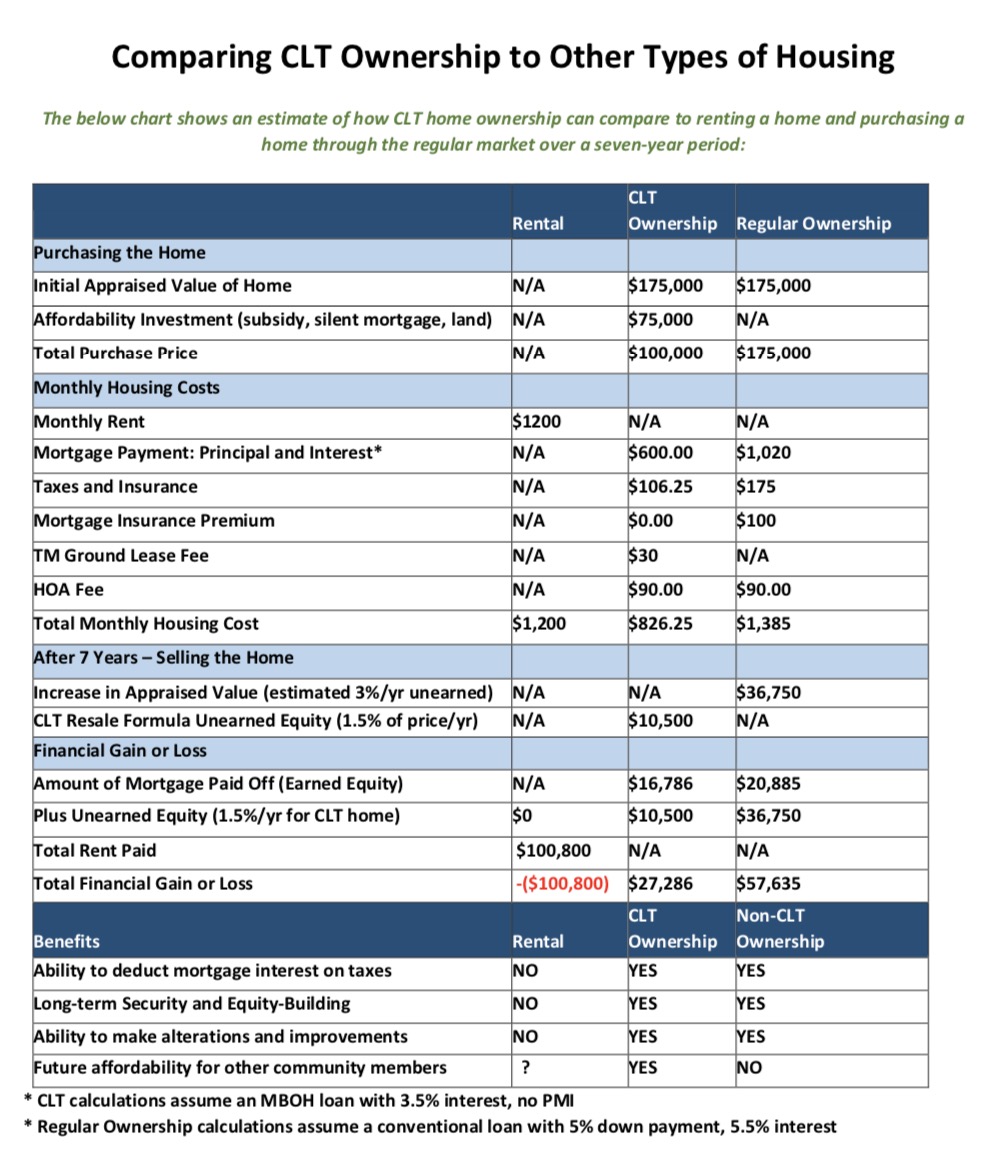

- If a CLT home owner chooses to sell the home, the home owner walks away with the equity they paid down on their mortgage, plus the amount of equity allocated via the resale formula: the resale price is calculated separate from market forces. Trust Montana home owners are provided with a maximum resale price that they can sell their home for — based on 1.5% simple interest per year of ownership. This resale formula is meant to balance permanent affordability with equity-building opportunity. The table below outlines costs and benefits of CLT home ownership, regular market-rate ownership, and renting.

Benefits of buying a CLT home through Trust Montana

- Affordability – CLT homes are more affordable than homes purchased on the open real estate market because the CLT and partner organizations provide affordability assistance to home buyers.

- Mortgage – stabilized, consistent, and affordable housing payments.

- Community – CLT home owners are important to Trust Montana — as part of a larger community of CLT home owners, they are encouraged to apply for membership on the Trust Montana board of directors..

- Support – If a home owner is having trouble paying their mortgage and is entering foreclosure, Trust Montana can help expedite a sale to a new home buyer to help the home owner out of a bad situation (note: there are no guarantees that a house will sell, just like in the regular market).

- Stability – home ownership provides stable housing costs and security. With this stability, home owners have a solid foundation that can allow them pursuit of other dreams, educational, vocational, or recreational.

- Equity — CLT home owners retain their earned equity and earn 1.5% per year on the value of the home.

- Tax benefits — home owner may receive federal tax deductions for mortgage interest and property taxes.